Jason Yeh is an ex-VC & the founder of Adamant, a group focused on making fundraising easier. Founders ❤️ binging his Fundraising Fieldnotes newsletter and podcast Funded before raising capital. Find Jason on Twitter: @jayyeh.

If you’ve seen, read, or listened to any of my work on fundraising, you know one of my favorite concepts to teach is Calendar Density. It’s a simple but powerful idea that drives optimal outcomes in fundraising. Up till now, I’ve only referenced the concept without deeply explaining it in prior essays. So here is the what, how, and why of Calendar Density – one of the absolute golden keys to great fundraising.

What is Calendar Density?

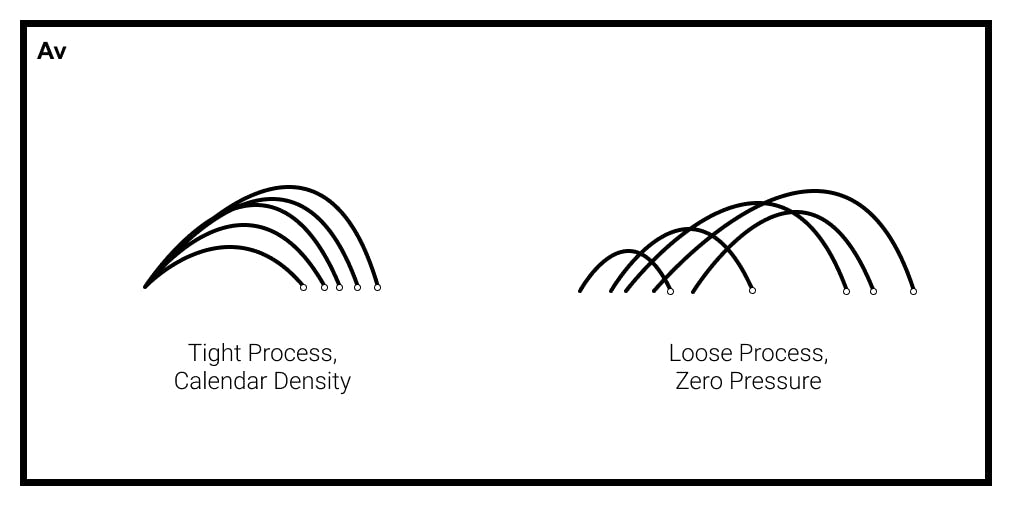

Calendar Density refers to the goal of scheduling most of your first meetings during a tightly packed, 2-week period. This usually looks like 5 or so pitch meetings a day for 2 weeks, although I’ve seen some crazy schedules with 8+ Zoom calls in a single day.

How do you Achieve Calendar Density?

To get to that hallmark starting point of tightly packed meetings, you’re going to have to ask for those meetings. And to ask for meetings, you need to have a list of people to ask. So, the very first step of pursuing Calendar Density is to create a lead list of target investors.

If we’re looking at pure numbers, in order to have a chance of packing 5 meetings a day over a 2-week (10 working days) period (50 meetings total), you’re going to need to start with a lead list of at least 50 investors. But that’s only if you’re converting 100% of leads, which of course is not reasonable. Depending on who you are and how powerful your network is, your ability to convert leads to meetings will vary. To err on the side of caution, let’s assume a 50% conversion rate. That means to start, you have to identify 100 potential lead investors to try to set up meetings with.

Next, determine how you’re going to secure warm introductions to these investors. This step will take time and effort. You’ll be surveying your network to see what connectors can possibly make an introduction. You’ll be warming up old connections to try to get those intros. And don’t stop at your own network – make sure your co-founders, advisors, and any other supporters are mining their networks as well. Devoting ample time and effort here enables you to then...

...Request the intro! This has to be done in a tightly packed time frame as well since there is some lead time from intro requests to actual intros being made. The best intro requests should be specific and reduce as much effort as possible. Beyond that, remember to project manage the intro request process. Your connectors are busy people and will need reminders and deadlines.

Finally, you need to set the timeline with investors. When you do get a successful intro, it’s now your time to grab the reins. Tell the investor when you’re starting to take meetings and politely ask if they have time in the 1-2 weeks that you designated. Ideally, the intro will happen at least a week before that timeframe to make sure investors’ calendars aren’t already packed. If an investor asks you why it has to be then or gives you a hard time, you can tell them, “Doing this well is really important so I’m just trying to set up the best process that I can. I hope you understand.” Believe me, they understand.

If you follow those steps, you’ll have achieved Calendar Density.

But Why?

Understanding the why behind a piece of fundraising advice is so important. Without it, founders try to blindly follow procedure and cannot creatively adapt to new situations. Here are the whys behind Calendar Density:

Pressure Signals

We talk a lot about signals in fundraising. Positive signals that steer investors into feeling the need to invest are a key part of any fundraise, and Calendar Density helps produce a variety of those signals. When your first meetings are all booked alongside other investor meetings, a number of signals naturally manifest themselves. With all the activity and energy bundled together, it’s likely the founder will very naturally say things that reveal the progress of the fundraise. For example:

- Apologizing for being late because of other meetings

- Not having enough slots available on a calendar to be completely flexible with investors

- Mentioning other investors that they're talking to

These are all signals which emerge from meetings being tightly bundled. Notice you don't need to explicitly say “another investor is very interested.” You can just say “I'm also talking to investors X Y and Z.” The realization that other investors are looking at the deal at the same time escalates the pressure. If there's something they like about the deal they’ll believe it’s an opinion shared by others and try to beat other investors to the punch.

Timelines

Architecting a fundraising process that has Calendar Density as a goal naturally adds timelines when you define your time period for first meetings. Timelines are incredibly powerful when it comes to herding investor interest. Investors are by nature very scatterbrained and easily distracted. If you can impose a timeline to follow, interested investors will divert their focus to you as timelines help apply priority to their jumbled to-do’s. Lastly, realizing that other investors are happy to follow an imposed timeline indicates that there are other investors very interested in the deal, which leads to even more pressure and signals.

Managing Rejection

Confidence is such an important part of fundraising. The feeling an investor gets when they hear a founder pitch is almost as important as the words that the founder says. A confident founder communicates passion and excitement. Those feelings are contagious. They can transfer over to an investor quite easily and, if so, make it more likely that an investor gets excited about backing the opportunity.

This is why managing the emotions of rejection becomes so important. Whether you're a first-time founder or have raised multiple rounds of funding, rejection in fundraising is not fun. It can be a confidence killer. It makes founders question what they're doing. It can kick off a downward spiral of thinking “Will anyone ever get excited about this??”

One amazing thing about Calendar Density is how effective it is at shielding you from the emotional impacts of rejection or bad meetings. In a loosely defined process, you might have one pitch meeting and not have your next meeting for another week. If that first pitch meeting did not go well, you'll have an entire week to stew over why things were so bad, why they didn't write you back, why they didn't respond more positively. You might be tempted to chase them down and try to get them to respond (bad idea).

Alternatively, if you have four or five meetings in a day for five days in a row, rejection can be written off as an investor “just not getting it.” You move on to the next one without giving those meetings much thought. With Calendar Density, you don't have enough time to worry about a crappy meeting. The understanding that you’ve set up a process with many meetings gives you a protective and attractive layer of calm confidence. This is a very real and positive impact of Calendar Density.

Fast Fail

Lastly, I’ve written about the value of the fast fail before. While we never plan for a failed process, we much prefer a quick one over a long, drawn-out failure. With Calendar Density, you set yourself up not only for the best opportunity to win but also to quickly close out a process that isn’t working out. The advantage of a fast fail is it gives you time and space to fix what’s not working, reset your narrative, and try again with a new process that again has… Calendar Density.

Start with the goal of Calendar Density and good things will follow.

P.S. Some additional help

Some people have told me this is a bit overwhelming!

To help organize thoughts, I pulled together a quick Calendar Density checklist with 3 email templates that will help you set up and execute a push for Calendar Density. Feel free to grab it here.